STAGFLATION

I would like to present some of my learnings on Stagflation. Any student of economics is aware of what Inflation is and we have seen examples in our own country where there is increasing trend of price rise and protests by people over rising prices. One is aware that inflation is the rate of increase in prices over a given period of time. Interestingly, however, a consistent and persistent inflation is actually called stagflation. One of the most glaring examples of stagflation was in the 1970’s.

The Oil Crisis of 1970

During the 1970’s and early 80’s, countries like the United States found themselves in a peculiar predicament. In the mid-twentieth century and after the World War II, OPEC (Organisation of the Petroleum Exporting Countries) members sought to gain greater control over oil prices worldwide although US was the largest producer and consumer of oil. Members of the OPEC proclaimed an oil embargo against the United States in retaliation to the US support for Israel during the 1973 Arab-Israeli War. As a result, the oil prices had risen from $3 per barrel to nearly 12 $ globally.

Stagflation was long believed to be impossible because until the 1970’s, there actually appeared to be an inverse relationship between unemployment and inflation as represented by the Philips Curve. But the oil crisis of 1973 and the subsequent aftermath broke down the relationship established between unemployment and inflation and sowed the seeds of a new concept in which both the quantities had a precipitous increase. As oil prices shot up, transportation costs also rose. In the oil crisis, as the supply of oil was restricted, the countries faced difficulty in adapting to higher energy costs, economic output plummeted and unemployment rose. This situation is known as a supply shock and occurs when there is a substantial change in the supply of a commodity. The supply shock is the most notable and prominent cause of the problem of stagflation.

What is stagflation?

In simple words, stagflation is a peculiar situation in which there is STAGNANT DEMAND, HIGH UNEMPLOYMENT and HIGH INFLATION. The term ‘stagflation’ was coined by the politician Iain Macleod in 1965 who said in a speech in the parliament, “We now have the worst of both worlds – not just inflation on the one side or stagnation on the other, but both of them together. We have a sort of ‘stagflation’ situation”. Stagflation has both short-term and long-term consequences.

The next step, therefore, is to see how stagflation can be cured or brought under control. Although it does not seem easy, yet there are few methods suggested by economists in curbing stagflation. The first would be to reduce the fiscal deficit of the government. Secondly, if stagflation is mainly due to supply shock, then the solution would be to reduce the money supply by increasing interest rates and quantitative tightening (QT).

Another interesting case study would be that of Brazil. Brazil is the largest economy in South America and the eighth largest in the world. Yet, it is an economy with a history of high inflation. According to the International Monetary Fund, its growth rate declined from 7.5% in 2010 to -3.25% in 2015. Its unemployment also saw a spike from 6.92% in 2011 to 12.82% in 2017. These data evince the existence of stagflation in Brazil.

Closer home due to the current covid impact on economy, the country is witnessing high levels of inflation as measured by WPI (Wholesale Price Inflation) of 14% and low economic growth of 6%. This is impacting employment and there are serious job losses associated with stagflationary environment. The key for governments is to stay ahead of the curve and avoid stagflation at all costs as the human costs associated with stagflation are way too high.

MODERN PAYMENT INFRASTRACTURE

Ensuring financial equality becomes a matter of paramount concern in a country like India where disparities might be diametrically opposed. To make financial resources more accessible and to reduce the effect of malpractices, our government began promoting the Cashless Economy and Digital India.

In April 2009 with the objective to integrate all the payment mechanism available in the country and make it uniform for retail payments, National Payment Corporation of India was formed. RBI in 2012 released a vision statement for a period of four years that indicated commitment towards building a safe, efficient, accessible, inclusive, interoperable and authorized payment and settlement system in India. It is part of the Green Initiative to decrease the usage of paper in domestic payments market.

Who could have predicted that a large influx of digital payments would occur in a country with a strong cash-based economy like India? A substantial portion of our society has adjusted to the use of digital transactions, from a tea vendor selling a Rs 20 Cutting Chai to a shop with an expensive product selection.

The trend towards the use of non-cash transactions and settlements began in daily life during the 1990s when electronic banking became popular. Today, we have many apps and outlets involving digital transactions and payments and India leads the world in real-time digital payments by clocking almost 40 per cent of all such transactions.

As the needs of investors and financial service users become more complex, there is a demand for effective tools to simplify the processes and transactions carried out by end-users. Given a rise in the use of automated services, it was inevitable that financial institutions would have to increase the number of digital services and offerings. As consumers look for less expensive alternatives to traditional financial services, organizations in the financial sector must adopt technology to survive. By the digitalization of the end-transactional client’s eco-system, fintech companies have taken the lead in revolutionizing the financial industry.

There are various methods of digital payments including banking cards, USSD, AEPS(Aadhar enabled payment system), UPI (Unified Payment Interface), and many more. Digital payments offer significant benefits to individuals, companies, governments, or international development organizations. The benefits of going digital include:

- Cost savings: Paper-based payment systems are not only pricey, but also cumbersome. A cheque’s clearance could take up to two weeks. Accepting a paperless system with electronic payments, however, is comparatively easy.

- Transparency and Security: Digital payments improve accountability and traceability, which consequently lowers corruption and theft. Compared to conventional, paper-based payments, electronic ones are far more effective and secure.

- Increased speed: Compared to traditional payment methods like cheques, electronic payments transmit funds significantly more quickly because they are made digitally. ePayments eliminate the need for consumers to visit banks by enabling them to make payments online at any time, from anywhere in the globe.

- Inclusive growth: Digital payments help unlock economic opportunity for the financially excluded, and enable a more efficient flow of resources in the economy.

Now that the need and significance of cashlesss economy has been brought into light, however, it does beg the question whether there were drivers that contributed to the growth of digital transactions. And, what were the economic interests of various players in this modern payment infrastructure?

Firstly, there were many drivers that contributed to the growth of digital transactions. Some of them are as follows:

- Demonetisation: Digital payment companies saw the huge usage of their market and also earned profit, as a result of demonetization, where after the ban of few notes people shifted promoting towards cashless transaction or economy.

- Growth of smartphones: With the rise of technology and arrival of digitalisation, smartphones were one of the key factors contributing to the growth of digital transactions.

- Government policies: The creative policy decisions to construct a Digital Payment Ecosystem and several outreach campaigns have poised India among the Digital Leaders of the world. These include schemes like the FASTag, Aadhaar Enabled Payment System, IMPS that have simplified payments to a large extent and contributed to the modern payment infrastructure.

- Push through PSBs: It is an initiative of RBI and Indian Banks Association (IBA), and includes ten promotor banks. The push through public sector banks (PSBs) has made a significant impact on the retail payment systems in the country.

- Cheap data: The cost of data is very cheap in India compared to countries globally. This has led to the growth of cashless economy.

Secondly, economic interests of various players were several and diverse. For long, the fintech industry rightly perceived that UPI and RuPay represent the government’s efforts to create a new payments ecosystem that can compete with global giants like Visa and Mastercard. The motivation of government is to build a world class payment infrastructure made in India without depending on Visa and Mastercard payment networks. The recent sanctions imposed on Russia by US on VISA/Mastercard further strengthened the suspicions on the government of India not to rely on external payment providers for internal domestic payments as VISA/Mastercard stopped operations in Russia overnight leading to chaos in the payment systems.

On the other end of the spectrum are payment gateway providers with their intention of seizing the market share. For instance, Razorpay, one of the prominent payment gateways, says that in 2019, UPI accounted for 38 % of its transactions compared with 46% of debit/credit cards. Razorpay even prognosticates UPI as a payments method to overhaul cards this year. The claim is supported by several other gateways and PoS companies including PhonePe, Paytm, who asserts that UPI transactions are mushrooming at a rapid pace which will prove to be a boon for their motive, i.e., to use the gains in market share in order to get a compelling valuation to their early investors through IPO of shares.

In addition, fintech companies like Google aim at return of and return on investment through the efforts of data monetisation using the payment data collected from citizens with the help of Big Data analytics to sell the data to third party companies for a fee. The data supporting the fact reveals that there has been USD 4 billion investment in UPI collectively, the majority of it by fintech companies. For instance, PhonePe’s valuation report ultimately boils down to the value and the number of customers, what revenue it will get, etc hoping to get a better valuation at the IPO table.

For long, the fintech industry rightly perceived that UPI and RuPay represent the government’s efforts to create a new payments ecosystem that can compete with global giants like Visa and Mastercard. The motivation of government is to build a world class payment infrastructure made in India without depending on Visa and Mastercard payment networks. The recent sanctions imposed on Russia by US on VISA/Mastercard further strengthened the suspicions on the government of India not to rely on external payment providers for internal domestic payments as VISA/Mastercard stopped operations in Russia overnight leading to chaos in the payment systems.

On the other end of the spectrum are payment gateway providers with their intention of seizing the market share. For instance, Razorpay, one of the prominent payment gateways, says that in 2019, UPI accounted for 38 % of its transactions compared with 46% of debit/credit cards. Razorpay even prognosticates UPI as a payments method to overhaul cards this year. The claim is supported by several other gateways and PoS companies including PhonePe, Paytm, who asserts that UPI transactions are mushrooming at a rapid pace which will prove to be a boon for their motive, i.e., to use the gains in market share in order to get a compelling valuation to their early investors through IPO of shares.

In addition, fintech companies like Google aim at return of and return on investment through the efforts of data monetisation using the payment data collected from citizens with the help of Big Data analytics to sell the data to third party companies for a fee. The data supporting the fact reveals that there has been USD 4 billion investment in UPI collectively, the majority of it by fintech companies. For instance, PhonePe’s valuation report ultimately boils down to the value and the number of customers, what revenue it will get, etc hoping to get a better valuation at the IPO table.

FUTURE OF DIGITAL CURRENCIES

The current state of digital currencies provides many opportunities for players in the infrastructure layer to come and gain huge market share. However, cooperation and adherence to regulations will be essential for the industry and economy’s long-term success.

What more can be done?

Private companies and governments can reduce the cost of their overall money operations across public and private channels by 4-5 times by utilising blockchain and related technology. In turn, this might increase the value for the country.

Although the technology behind UPI comes from India, CBDCs are facing intense competition on a global scale. The real competition in this situation is to consolidate and extend the dominance of the country’s CBDC or digital currency across numerous geographies. Making it as commonplace as possible is the first step in this situation. Due to their appealing economic structure and open nature, smart consumers have already embraced digital currencies; however, only time will tell how they will react to a more regulated version of the same.

CONCLUSION

Today, there is no denying that India’s digital payment landscape has changed in the present. In addition to the government’s efforts, Indians have shown a strong propensity for embracing new technologies. India has emerged as a pioneer in the production of digital assets, which can serve as an example to many other countries, while some developed countries are experiencing issues owing to insufficient digital infrastructure for moving money to the accounts of their inhabitants. Additionally, the Indian government is doing all possible to position India as a world leader in the field of digital payment systems and support it in becoming one of the most effective payment marketplaces in the world.

By allowing transparent, safe, quick, and affordable processes that benefit the whole digital payments ecosystem, rising fin-tech companies will play a significant role in the continued expansion of digital transactions in the future.

COVID – 19 – ECONOMIC IMPACT ON SOCIETY

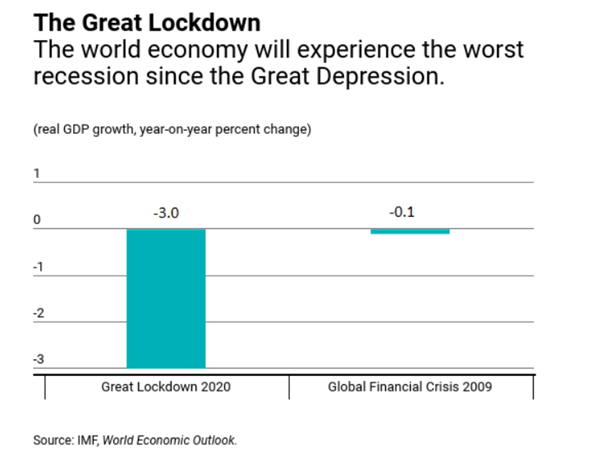

“The cumulative loss to global GDP over 2020 and 2021 from the pandemic crisis could be around 9 trillion dollars, greater than the economies of Japan and Germany, combined.” remarks the International Monetary Fund (IMF). The COVID-19 pandemic has probably given the biggest blow to the world economy after the great depression of 1930s. This short essay will describe the various economic impacts to society due to Covid-19.

Covid pandemic has affected the lives of millions of people throughout the world. The economic impact of this Great Lockdown, the worst recession since the Great Depression, is so legion that enumerating them would prove to be a tough row to hoe.

Following are some of the crucial impacts and ramifications of the pandemic on the Indian economy and its people.

- Firstly, the supply chain management in the FMCG sector, the fourth largest sector of the Indian economy, is disrupted significantly. This has resulted in many FMCG firms unable to ship products to end consumers. The demand for some products spiked and some dropped. Doubling capacity from the suppliers was not possible overnight as the FMCG giants ran a tight and efficient chain. This resulted in significant delays to product shipments and spike in product prices which were in demand.

- The second impact is on inflation experienced by the poor and middle class. As food inflation spiked due to supply chain disruptions caused by the lockdown, Sharma, 43-year-old, who drives an autorickshaw in New Delhi, said that all his hope has turned into gloom.

- As hospitals started to overflow and there was need to make payments to near and dear ones, there was a dent on household savings as they had to pledge/sell their assets to take care of their loved ones.

- The COVID-19 pandemic has exposed all the existing cracks in our society, one of the most crucial being the acute food insecurity faced by a large portion of the population. Although food insecurity was prevalent in India even before the pandemic, the trend, however, was exacerbated as India went into lockdown among India’s penurious and migrant populations, whose lives gradually became even more dubious. “Since the onset of the pandemic, one out of every three children below the age of five years, is suffering from chronic undernourishment.”, states The National Family Health Survey(NFHS 5).

- Demand destruction was visible in the auto shipments and petrol/diesel sales. This impacted the overall GDP of the economy.

- Since schools and colleges were closed, the livelihood of maids, school bus drivers, support staff got a hit because of layoffs.

- The hotels, restaurants and aviation industry took a big hit as people postponed their travel plans. The chart below shows the negative impact

Even though there were many negative impacts on society, there is a silver lining in all of this as well. These include:

- The pharmaceutical sector has seen a rise in the Covid-19 pandemic, with a spike in the consumption of generic drugs globally.

- The lasting impact would be on awareness on cleanliness and need to maintain personal hygiene.

- Since many impacted families include people who did not maintain proper exercise and weight, the covid pandemic has exposed the need to maintain good health going forward.

As a saying goes, “Never let a crisis or an opportunity go waste”, it is imperative for the society to ponder over the vulnerability of the poor and middle class, the marginalized and work on remedial actions which will help in better lives of all sections of the society.

CONSUMER PROTECTION – A NEED

No matter where we, as consumers, buy things in the marketplace, we have a very important right to know the truth behind what we are going to buy. There are many cases where consumers are exploited in the market. The consumers have a number of rights regarding the purchase of things, but at the same time they have some responsibilities too. We have the RESPONSIBILITY to:

- Shop carefully and wisely

- Understand the terms of the sale

- Ask questions about the product.

In brief, we have the RESPONSIBILTY to know our right as a consumer.

Who is a consumer?

A consumer is a person or a group who intends to buy or obtain goods or services and is in the receiving end of a market transaction. In short, a consumer is a person or a group who intends to order, orders, or uses purchased goods, products, or services primarily for personal, social, family, household and similar needs, not directly related to entrepreneurial or business activities. Production, and consumption are the two ways through which people participate in markets. We become consumers when we buy final goods and services and use these goods for consumption and deriving satisfaction.

Consumer protection is the practice of safeguarding buyers of goods and services, and the public, against unfair practices in the marketplace. In other words, it is a group of laws and organisations designed to ensure the rights of consumers.

- It is a way of preventing consumers as well as the state rom financial scams, financial frauds and bankrupt businesses.

- Countries like Australia, Brazil, United States of America and the United Kingdom, have consumer protection laws in the nation-state level.

- They also have specific state organisations to help their consumers.

Why do we need Consumer Protection?

- Consumer is being exploited by through the ways of adulteration, false practice, fake weights, incomplete information on packaged products.

- Consumer needs to obtain accurate, unbiased information and details about the product, good or service.

- Consumer Protection helps markets work for both consumers and businesses.

- It also provides physical protection to consumers for example protection against products that are unsafe or dangerous to his/her health and welfare.

- The development of consumer protection is evolutionary and its mechanism is changing from the changing needs of consumer.

Consumer Protection is a concept that was first introduced by John Fitzgerald Kennedy, the 35th President of the United States on 15th March 1962. The need for consumer protection arose out of dissatisfaction of the consumers as many unfair practices were being indulged in by the sellers. In India, the consumer movement originated with the necessity of protecting and promoting the interests of consumers against unethical and unfair trade practices.

Case Study 1

The following is a 2nd year Research conducted by Consumer Unity & Trust Society (CUTS) in Rajasthan in Jan 2012

Objective:

- The objective of this research under the second year of the project was to gauge the consumer awareness level on consumer issues at the grassroots level.

- For this, 2349 consumers were targeted in 12 project districts of Rajasthan.

- Part A of the perception survey was to know their level of awareness and perception about consumer rights and issues. Part B was to know consumer perception about issues related to edible items, especially Atta and Ghee

Observations:

- 35 percent respondents were unaware of their rights as a consumer and 26 percent knew these partially.

- A sorry figure of almost 42 percent expressed their ignorance about their responsibilities as a consumer and only 21 percent said that they know these partially.

- 85 percent of the total respondents expressed their awareness of the general definition of consumer, 37 percent had heard about the Act and the rest either did not know about it or had very little knowledge.

- Only 10 percent of respondents went to consumer fora for seeking redressal.

- 53 percent respondents showed their awareness of demanding bills and 55 percent said that they knew about MRP and its importance.

- 77 percent see the manufacturing and expiry dates before purchasing goods and 85 percent out of this 77 simply avoid buying these.

- 70 percent of the respondents reported that, after “Ghee”, Edible Oil and Spices, basic commodities like Aata (Wheat flour), Milk, Pulses and Petroleum products are the most adulterated

Recommendations and Conclusions:

There should be:

- Increased awareness of the consumer rights through media campaigns like Jago Grahak Jago

- Increased checks on products

- Well-equipped product testing laboratories should be established at district level

Case Study 2:

Ashish Jain, resident of Uniyara Tehsil in Tonk district purchased a printer form Kota worth Rs.5000 with a guarantee of one year. But, it got defected within five months of its purchase. He went to the local shopkeeper, but since it was under the warrantee period the shopkeeper advised him to visit the service centre of the company.

After contacting the service centre he was told that the drum of the printer is having problem and needs to be replaced. The dealer refused to replace it and asked him to contact to Kota dealer. On contacting the dealer in Kota, he was refused by the dealer saying that it cannot be replaced. Then he contacted Gopal Lal Saini of MMM Shikshan & Jan Seva Sansthan our district partner of Tonk, who contacted the dealer in Kota and asked him to resolve the case and replace the printer. The dealer denied this but after threatening him of going to consumer forum; he finally agreed to replace the printer without charging any extra money. In this way Ashish Jain got justice with the help of the organisation.got justice with the help of the organisation.

The above is a success story of consumer protection that inspires us to be aware and conscious about our rights as a consumer not falling under the trap of shopkeepers and salesmen.

The following could make consumer protection more effective:

- Make sure that new technology works for consumers rather than against them. Examples would include leveraging technology to raise consumer complaints through whatsapp and other social media channels, recognizing the complaints as if they are submitted physically.

- Have appropriate and effective redress in place for when things go wrong.

- Shift the burden of accountability and caution upon the manufactures, sellers, and service provider, giving more power to consumers

- Better return policies for e-commerce websites like flipkart , amazon

- Increase the level of awareness of consumer protection rights through higher advertising (billboards, TV campaigns etc)

Hence, it can be concluded that both Government and consumers should make efforts collectively to create awareness about the rights and responsibilities of the consumers and to reduce exploitation of consumers.

India has been observing 24 December as the National Consumers’ Day as on this date, Indian Government enacted Consumer Protection Act, 1986. There are today, about 20-25 well organised and recognized consumer groups in today out of 700 hundred.

In short, for the speedy process of the consumer movement, we require a voluntary effort and active participation of the people. We, as consumers must be aware of our CONSUMER RIGHTS.